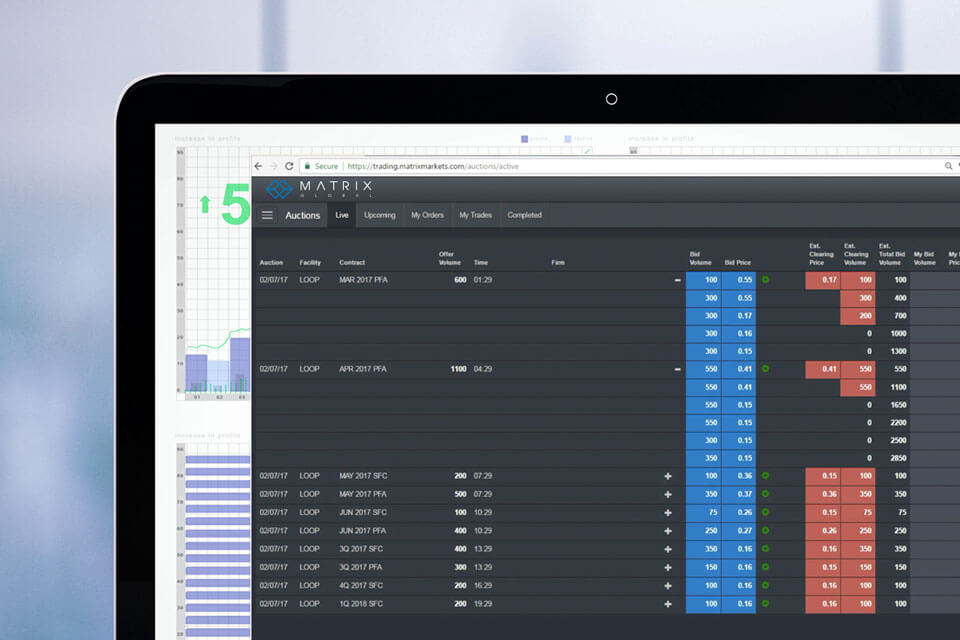

The Matrix Auction Platform

Matrix Global creates innovative solutions for the energy storage industry. Storage facility operators and their product owners can now transact efficiently, transparently and cost-effectively using the Matrix Auction Platform (the MAP).

The MAP Has Revolutionized the Storage Industry

Traditionally, storage facilities sell their capacity in the form of multi-year leases. This process is opaque and disadvantageous to both buyers and sellers. Buyers cannot readily determine the market price for capacity, and sellers don’t have a clear picture of the demand for capacity. The MAP challenges the status quo by offering a transparent auction-based platform for the purchase and sale of storage.

Through the MAP, storage capacity is sold in the form of proprietary short-term physical bilateral agreements (PFAs) by means of an online, browser-based auction process that is managed and hosted by Matrix Global. The MAP may be customized to meet a facility’s particular needs:

- The term of the PFAs can be as short as one month and as long as a year.

- The PFAs can start either during first nearby month or months (of years) in the future.

- The capacity underlying these PFAs can be either comingled storage in one or more tanks or exclusive storage in a single tank.

- Auctions may be structured so that participants bid on the right to purchase (or not) storage capacity at a set future date.

- Capacity can also be auctioned in the form of listed futures contracts with clearinghouse intermediation between the storage facility and the purchaser.

Both storage facilities and product owners benefit from MAP:

- Storage facility owners receive the best price for their capacity through a competitive bidding process. They can also use the MAP to hedge their market risk by creating a portfolio of both longer-term storage contracts and shorter-term PFAs.

- Storage capacity purchasers can be confident that they are paying at a market rate. They are also able to purchase only the storage that they need rather than buying years’ worth of excess capacity.

MAP was developed to optimize the value of the facility’s storage assets through the creation and management of independent auction “portals” for vetting bids and setting unique auction criteria.

- Publicly verifiable history of all bid placements and the bid selection process.

- Reduced carrying costs through consolidation of bid marketing, due diligence and closing process.

- Real-time, online data access for all auction participants for increased transparency and efficiency.

How MAP Benefits Its Participants

Matrix introduced the world’s first standardized contracts for the storage of crude oil. These contracts can take the form of both listed and cleared futures and bilateral physical forward agreements (PFAs). Storage facilities auction these contracts to market participants by means of the MAP. The MAP has made it easier for purchasers to acquire short- and intermediate-term storage capacity without entering into long-term commitments. Thus, the MAP mitigates purchasers’ counterparty risk through either a clearinghouse guarantee (for futures contracts) or upfront payment by purchasers (for bilateral PFAs), and, at the same time, reduces the market and credit exposures that are inherent in long-term contracts.

Post-auction, these contracts can be traded to other market participants, which substantially increases purchasers’ flexibility. The value of a storage futures or bilateral PFAs has a direct correlation to a calendar spread option, due to the inherent optionality embedded in both. With a better understanding of this dynamic, trading companies can develop more complex and profitable strategies for trading both derivatives and physicals.

The MAP gives storage providers a flexible tool to sell their capacity.

1. Downturn in tank storage demand:

- Due to advanced market information tools OPEC+ are able to control supply and keep global markets tight.

- Current market dynamics and shape of the crude curve has resulted in depressed demand and value for tank storage.

- Customers are reluctant to lock-in term contracts at any price.

- The current customer base is insufficient to generate robust demand-side competition for storage.

- Customers delay 1-on-1 negotiations and renewals when favorable to them, resulting in reduced and/or lost revenues.

2. Information asymmetry disadvantageous for storage companies:

- Customers are highly sophisticated and able to analyze market conditions and evaluate storage value on a real-time basis.

- Customers have superior access to data affecting storage value and can evaluate and respond to changes in market conditions faster.

- Customers prefer to negotiate 1-on-1 with terminal so they can exploit this information asymmetry to their benefit.

- Customers create free options (and value) that benefit them by delaying negotiations and renewals when market conditions are unfavorable or uncertain, resulting in lower or lost revenues for storage facilities.

3. The MAP levels the playing field for storage operators:

- Storage operators can address any backwardation of the crude oil curve by offering storage contracts that begin months (or years) forward, e.g. three months, one year forward.

- The MAP will attract new, non-core customers who are primarily interested in purchasing short-term storage capacity rather than entering into long-term leases. Moreover, Matrix will work with the facility’s marketing team to actively market auctions to existing and new customers.

- Real-time storage auctions eliminate the delays inherent with traditional negotiations.

- Customers compete against each other when storage is sold in an auction, which reduces (or even eliminates) the effectiveness of their information edge while maximizing the value of the storage capacity.

- The MAP allows storage operators to monetize the value of the calendar spreads that are implicit in contracts for storage capacity.

Please take a few moments to look as this MAP information

- Here is a video demo of a standard auction for one-month strips of comingled storage capacity.

- Here is the User’s Guide for standard auction of comingled storage capacity

- Here is a video demo of a single-tank storage capacity auction.

- Here is the User’s Guide for single-tank storage capacity auctions.